|

Perth AUSTRALIA

Posts: 253 since Jun 2017

Thanks Given: 79

Thanks Received: 87

|

Hi Traders

I have been trading Live for almost 2 years, i have a slightly positive last year, abt +6% with a DD similar to that. This year i tried to increase my trade size (double up) and didnt do very well (first half 2017 down 10%, Currently still down 6%). From my journal and review, i am quite comfortable to say there is a very limit number of evil trades ( which i mean trade by technical error or go against plan).

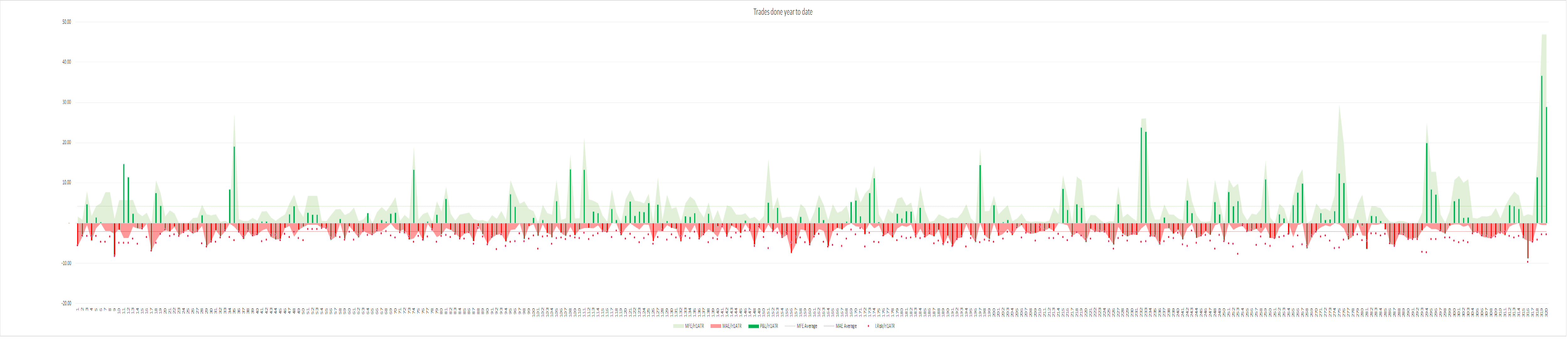

I shared my last year equity curve and some trade information in my Trading Journal:

These trades were done in 13 different markets: Corn Wheat Soybean Crude Natgas EminiS&P EminNasdaq Euro Dollar Gold HGCopper US30years Coffee (ICEUS) Sugar (ICEUS). I would consider myself doing Swing Trading, average number of days i hold trade is 2.11 days, longest ever 12, shortest ever in a split seconds. Primary Timeframe for execution from h1 ( 60mins), trend derived from h4 (240mins), occasionally drill down to m20 (20mins) for trade management.

This is how the graph looks like, if i m doing it correctly ( i find it easiest to read this way)

myself on one hand,looking at MAE MFE vs initial risk, i m working on manual backtest (using excel) to see if a smaller initial risk to be taken will get me a better trading result. i have an idea how to come out with a stop that is not principally against my existing strategy, a typical thought hoping to cut loser small, and bring up my profit expectancy. and i also see from the graph, my good winners seems to have smaller MAE relatively.

on the other hand, looking at MFE vs actually winning trade, i also work on manual backtest (using excel) to see if aggressive scale-out in some case, using Daily or Weekly ATR as a guide from the point of entry, will work better. my rationale behind is base on my average trade duration 2days. will it make sense if i take profit earlier if price hit a weekly ATR kinda big move during the life of my typical trade. this is not my exit style where i have nv set a traget profit, i trail my stop base on new market/vol profile information, and let it die eventually/naturally (trend following). but i m thinking i should consider this way especially i have more than 2-3 contracts running in good profit.

I am not sure if i m behind any blind spot, i do not have professional trading experience, neither do i have a math degree, everything self-learned from various resources. Glad that i have this place to share and to hear from members here. I would like to hear from anyone willing to share what would they do to improve their strategy, base on their MFE MAE. Or best, if anyone can comment on what i had done, what i am doing, in term of using MFE MAE information to improve my trading result.

Cheers

DarrenC

|